On the Raleigh campus, the MSc Financial Markets has a Financial Analysis and CFA® preparation track

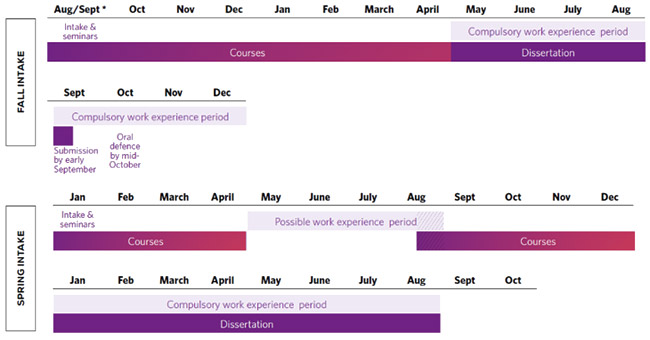

Course calendar

Spring intake is only available for the first year of the Two-year MSc. This allows students to acquire professional experience for eight to nine months.

Find out more about the first year of the Two-year MSc programme.

Courses by semester

The CFA® track

RALEIGH CFA TRACK: FOCUS ON THE CFA® CANDIDATE BODY OF KNOWLEDGE (CBOK) – in partnership with the CFA® Institute.

This track prepares students for the CFA Level I and II exams, however the priority is academic achievement in curriculum courses.

Six scholarships will be offered (waives one-time $450 enrolment fee for Level I candidates and reduces registration fee to $350 for Level I & II candidates) based on qualification exam at the beginning of classes.

Offers students the valuable opportunity to accelerate their course learning by pursuing the CFA license while in school.

Offers students the possibility to participate in CFA Institute meetings, students’ competitions, and research seminars.

Gain valuable work experience in the USA

SKEMA students enrolled in the MSc International Business or MSc Financial Markets & Investments in Raleigh who are not American citizens or permanent residents of the USA may apply for Optional Practical Training (OPT). OPT permits eligible students to apply for an Employment Authorisation Document (EAD) allowing them to work in their field of study in the USA for up to 12 months without applying for a new visa. Eligibility requirements: finish their final two semesters in Raleigh and satisfactorily complete all coursework.

CFA® is a registered trademark owned by CFA Institute