Finance

Programme

MSc Financial Markets & Investments - Master of Science Finance

Ranked among the world's top programmes, SKEMA Business School's Master of Science in Financial Markets & Investments offers a cutting-edge, market-oriented finance education. This internationally recognised MSc financial markets programme combines academic rigour with hands-on training, preparing students for high-impact careers in investment banking, financial analysis, trading, and asset management.

Informações práticas

Tipo de Curso

Integral

Duração

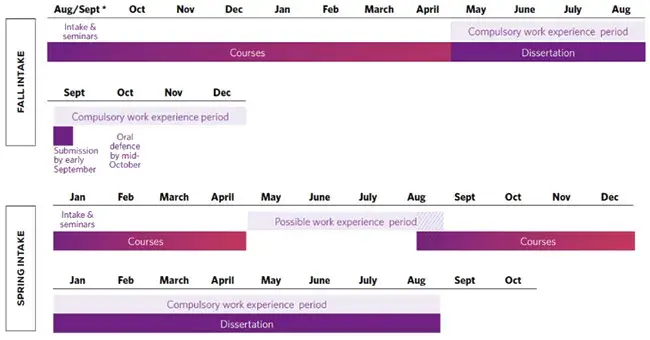

1 or 2 years

Investimento

€29,500 for the 1-year MSc / €47,000 for the 2-year MSc

Localização

Paris (França), Raleigh (EUA), Sophia Antipolis (França)

Idioma de Ensino

Inglês

Data de entrada

Setembro, Agosto

Seu nível de formação

., Ensino Superior

Graduação

Pós - Graduação

Master of Science in Financial Markets & Investments: Programme Overview

Students are educated in a custom-made academic environment that facilitates success across a wide variety of market finance jobs. The MSc gives students practical expertise for key areas of finance in the new post-crisis environment and AI innovations. Students learn the latest methods in trading, sales, investment banking (PE, M&A), asset and wealth management, risk management, ethics and compliance, as well as sustainable finance in different tracks.The programme is market-oriented and practical where students are trained to make an immediate impact in their first job. The availability

of Bloomberg terminals with live quotes and up-to-date financial information further prepares students to have a better understanding of the markets ahead of their transition to industry.

The programme is built on three pillars: financial asset knowledge, quantitative tools and financial markets advanced methods & practices.

2025: 2nd place worldwide in the 2025 FT Finance Ranking

The QS 2024 ranking placed this MSc 28th worldwide and 21th among the European schools represented.

-

The Master of Science (MSc) Financial Markets & Investments at SKEMA stands out as a leading programme for those seeking advanced expertise in finance and global market dynamics. Here’s what makes this master in financial markets unique:

- Highly international classes allow students to build fruitful inter-cultural relationships.

- Classes are taught by professors who have solid academic backgrounds and by seasoned professional in the industry.

- Teaching emphasises a hands-on, problem-solving approach that allows graduates to work productively from their first day of work.

- The programme is developed constantly to ensure its relevance to job requirements in a shifting market. Classes are also complemented by talks given by full time, high-calibre practitioners and finance tracks.

- Strong links with alumni who have reached top positions around the world.

- Throughout the year, students develop professional contacts, get access to information from a variety of sources, and learn from each other. The highly international make-up of classes makes it very easy to create a global network of friends and colleagues.

- Use of the Bloomberg terminals and simulation games delivers reality-based training.

-

Regarding the increasing complexity of market finance, we offer common fundamentals and four different specialisations spread over the four campuses:

- Trading, Sales and Structuring in Sophia Antipolis (in Paris from Fall 2027),

- Asset Management in Paris (in Sophia Antipolis from Fall 2027),

- Investment Banking in Paris,

- Financial Analysis and the CFA® preparation track in Raleigh + OPT visa to insert in US/Wall Street,

Imagem

The classes are built on a diversity of student backgrounds and professional experiences. Highly international classes reflect the reality of working in today’s global business environment. The teaching is provided by a subtle mix of prestigious practitioners and our international faculty members who have both strong academic and professional experience.

Discover the MSc Financial Markets & Investments programme in videos

MSc Financial Markets & Investments: courses and campuses

Life in Paris, Sophia Antipolis and Raleigh

Read our PDF guides to learn more about your future life in Paris, Sophia Antipolis and Raleigh. Learn all about our campus, transportation, main attractions and events as well as practical information that will help you make the most of your experience:

Artist/Entrepreneur/Athlete and Student: It’s Possible!

SKEMA offers tailored arrangements for individuals with special statuses, enabling them to successfully pursue a dual path: obtaining a higher education degree while continuing their professional careers.

These programmes are built on curriculum flexibility, notably through a course system that includes tailored measures for each type of activity, providing a real solution to support the success of dual academic and professional ambitions.

The High-Level Athlete Track

The course system offers students the following:

- Possibility to extend the duration of studies (by 1 to 2 years) without any additional tuition fees (HLA – High-Level Athletes) / academic years may be split

- Personalised timetable arrangements, based on a detailed review of both sporting and academic calendars

- Tailored support including academic and athletic mentoring, follow-up, and specific assistance dedicated to the needs of athletes

- Adaptation of internship and exam arrangements in case of competitions.

- Flexible international experience if needed

- Recognition of athletic commitment through the award of 3 ECTS credits.

Documents to be submitted in addition to your application:

- Athletic CV with record of achievements

- Sports motivation letter

- Copy of your current year’s federation licence or club certificate

- Sporting goals, training, and competition schedule for the coming year

- Certificate of inclusion on the Ministry of Youth and Sports list or from the training centre (if applicable)

Admissions

Imagem

| French State Certification label guaranteeing the reception facilities quality offered to international students. More information here |

Financing

Tuition fees for the academic year 2026-2027, provided for information purposes and subject to change. Definitive amounts will be those mentioned on the contract at the date of registration.

Career opportunities after completing an MSc in Financial Markets & Investments

Graduating with a Master of Science in Finance or a Master in Financial Markets from SKEMA opens the door to a wide range of high-potential careers in the finance industry. Here’s what you can expect after completing your degree:

Contact us

A team is at your disposal for any further information you may require.

International Admissions Development Manager

Pierre AVOT

Student Recruitment Manager

(US students applying to Raleigh)

Thomas Ragot

Próximos eventos

MSc Financial Markets & Investments - Q&A

-

• The One-Year MSc is a full-time programme completed in one academic year, available on the Paris, Sophia Antipolis and Raleigh campuses.

• The Two-Year MSc spans two academic years, with the first year focused on foundational courses and the second year on advanced specialisation and professional preparation. The first year is available on seven campuses: Paris, Sophia Antipolis, Lille, Belo Horizonte, Raleigh, Suzhou and Dubai, and the second year on the Paris, Sophia Antipolis and Raleigh campuses

-

Each campus offers a specific track. You may choose your campus based on the specialisation that aligns with your career goals. Regardless of location, all tracks prepare students for a wide range of finance roles.

-

The MSc Financial Markets & Investments (FMI) at SKEMA is distinctly international in its outlook, as evidenced by the fact that a big majority of graduates work outside their country of origin. The programme opens doors to a wide range of sectors, including finance, banking, insurance, consulting, and engineering, and prepares students for diverse careers such as trader, broker, financial analyst, asset or portfolio manager, investment banker, risk manager, private equity specialist, or wealth manager. Career opportunities are further enhanced by specialisations tailored to each campus, enabling every student to target the sector or role that best matches their ambitions. MSc FMI graduates are recruited by globally renowned companies, reflecting the programme’s international recognition and strong employability.

-

The programme welcomes students from diverse academic and professional backgrounds. Core modules build foundational knowledge before diving into advanced topics. For admission and to thrive in the programme, however, it is advisable not to be a complete novice in one or more related areas: financial economics, financial analysis, VBA or Python programming, fundamentals of financial instruments and asset classes, and basic mathematics.

-

Students have access to:

- Bloomberg terminals for live financial data and analysis

- Simulation tools for real-time trading experience

- Guest lectures from top finance professionals

- Career services and networking opportunities with alumni and recruiters

-

Teaching combines academic rigor with real-world application. Faculty members include PhD-holders and industry experts. The curriculum is constantly updated to reflect market trends and employer needs.

-

Yes. The MSc FMI is ranked 2nd worldwide in the 2025 FT Finance ranking. It is highly respected by employers globally and supported by partnerships with major industry bodies such as the CFA® Institute.

By joining an MSc, students obtain a master of science degree and the "Diploma of Specialised Studies in International Management" (DESMI), a degree approved by France's Ministry of National Education, Higher Education and Research (master's level. More info - text in French). -

The MSc Financial Markets & Investments (FMI) is designed for students aiming to work in financial markets, with a focus on trading, structuring, portfolio management, investment banking, and asset management. It includes specialisations that cover both the buy-side and sell-side of finance and offers a dedicated track for CFA® preparation in Raleigh. The programme is highly market-oriented, with practical training on Bloomberg terminals, simulation games, and quantitative tools used in front-office roles.

In contrast, the MSc Corporate Financial Management (CFM) prepares students for corporate finance and advisory roles within companies, consulting firms, or private equity. It focuses on financial strategy, fundraising, M&A, risk management, and fintech innovations, with five specialisation tracks including Financial Advisory, Private Equity, Fintech, and Risk Management. The CFM programme emphasises in-company projects, financial modelling, and blended learning methods for applying finance to real business challenges.

-

• Objectives and positioning

SKEMA’s MSc FMI is distinctly positioned with a strong emphasis on financial markets and front-office careers. It is designed to prepare students for roles in areas such as trading, asset management, quantitative finance, and investment research.

In contrast, many traditional finance Master’s programmes tend to offer a more general overview of finance, combining corporate finance, accounting, and market finance without a strong specialisation. As such, the FMI programme is ideal for students specifically aiming to pursue careers in capital markets rather than broader financial roles.

• Programme content and specialisations

The FMI curriculum is highly technical and professionally oriented. It includes in-depth modules on derivatives, portfolio management, financial engineering, risk modelling, and programming (e.g., Python, VBA). It also offers preparation for globally recognised certifications such as the CFA, FRM, or CAIA.

Other finance Master’s programmes may offer fewer technical components and typically provide a more generalist approach, with specialisation tracks that are often optional or less market-focused. FMI, by contrast, delivers a coherent and specialised learning path from the outset, rooted in real-world market scenarios and practical applications.

• Career opportunities

Graduates of the MSc FMI often secure roles in top-tier investment banks, hedge funds, asset management companies, and financial institutions, particularly in front-office or quantitative roles such as financial analyst, trader, quant analyst, or portfolio assistant.

In comparison, general finance Master’s graduates tend to enter a wider variety of roles, including positions in corporate finance, internal audit, or financial control, which are less directly connected to capital markets.

SKEMA’s strong connections with key financial hubs (such as London, Paris, and Geneva), along with its alignment with industry expectations and certifications, significantly enhance graduate employability in global financial markets.

-

Yes, SKEMA offers a range of scholarships and financial aid options for both international and domestic students. These include merit-based scholarships, need-based support, and country- or campus-specific awards. For detailed information on eligibility and application procedures, please visit SKEMA’s financial support page.