On the Paris campus, the MSc Financial Markets has an Asset Management track and an Investment Banking track

The MSc Financial Markets & Investments tracks on the Paris campus bring students together from all over the world with diverse backgrounds. The tracks shift from being academic in the first semester to a more hands-on approach featuring experienced professionals in the second term.

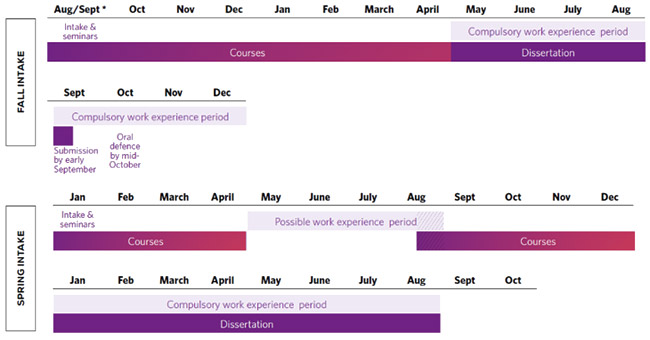

Course calendar

Spring intake is only available for the first year of the Two-year MSc. This allows students to acquire professional experience for eight to nine months.

Find out more about the first year of the Two-year MSc programme.

Courses by semester

Recommended reading

The best way to prepare is to start class books (which will be required reading over the first semester, with some preliminary self-study - see above) or to read the Financial Times / Wall Street Journal, etc. every day.

Of course many other books, including in particular those suggested by Amaury Goguel, the Paris MSc Financial Markets & Investments director, are excellent readings. You will receive, upon selection and registration, additional details. Some courses to level up are included in the programme and take place at the beginning of the year, just after intake.