Finance

Programme

MSc Financial Markets & Investments - Master of Science Finance

Classé parmi les meilleurs programmes au monde, le Master of Science in Financial Markets & Investments de SKEMA Business School offre une formation en finance de pointe, orientée vers les marchés. Ce programme de MSc en marchés financiers, reconnu à l’international, allie rigueur académique et formation pratique, préparant les étudiants à des carrières à fort impact dans la banque d’investissement, l’analyse financière, le trading et la gestion d’actifs.

Informations pratiques

Type de programme

Temps plein

Durée

1 ou 2 ans

Frais de scolarité

29 500€ pour le MSc 1 an / 47 000€ pour le MSc en 2 ans

Localisation

Dubaï (Emirats Arabes Unis), Paris (France), Raleigh (États-unis), Sophia Antipolis (France)

Langue

Anglais

Date d'entrée

Septembre, Août

Niveau d'admission

Bac+3, Bac+4

Diplôme

Bac+5

Master of Science Financial Markets & Investments : présentation du programme

Les étudiants sont formés dans un environnement académique sur mesure qui favorise la réussite dans une grande variété de métiers de la finance de marché.

Le MSc apporte aux étudiants une expertise pratique dans les domaines clés de la finance dans le nouveau contexte post-crise.

Les étudiants apprennent les méthodes les plus récentes en trading, ventes, banque d’investissement (capital-investissement, fusions et acquisitions), gestion d’actifs et de patrimoine, gestion des risques, éthique et conformité, ainsi qu’en finance durable à travers différents parcours.

Le programme, orienté vers le marché et très concret, prépare les étudiants à avoir un impact immédiat dès leur premier emploi.

L’accès à des terminaux Bloomberg, fournissant des cotations en direct et des informations financières actualisées, permet en outre aux étudiants de mieux comprendre les marchés avant leur entrée dans le monde professionnel.

Le programme repose sur trois piliers : la connaissance des actifs financiers, les outils quantitatifs et les méthodes et pratiques avancées des marchés financiers.

2025 : le Financial Times classe ce MSc au 2ème rang mondial

Le classement QS 2024 place ce MSc à la 28ème position mondiale et à la 21ème parmi les écoles européennes représentées.

-

Le Master of Science (MSc) Financial Markets & Investments de SKEMA se distingue comme un programme de référence pour ceux qui souhaitent acquérir une expertise approfondie en finance et en dynamique des marchés mondiaux. Voici ce qui rend ce master en marchés financiers unique :

- Des classes fortement internationales permettent aux étudiants de nouer des relations interculturelles enrichissantes.

- Les cours sont dispensés par des professeurs disposant à la fois d’une solide formation académique et d’une expérience professionnelle dans le secteur.

- L’enseignement met l’accent sur une approche concrète et axée sur la résolution de problèmes, permettant aux diplômés d’être opérationnels dès leur premier jour de travail.

- Le programme est continuellement actualisé afin de rester en adéquation avec les exigences des métiers dans un marché en constante évolution.

- Les cours sont également enrichis par des interventions de professionnels expérimentés et de haut niveau, ainsi que par des parcours spécialisés en finance.

- De solides liens sont entretenus avec les anciens élèves occupant aujourd’hui des postes de haut niveau à travers le monde.

- Tout au long de l’année, les étudiants développent un réseau de contacts professionnels, accèdent à des informations issues de sources variées et apprennent les uns des autres.

- La dimension internationale marquée de la promotion facilite grandement la création d’un réseau mondial d’amis et de collègues.

- L’utilisation des terminaux Bloomberg et des jeux de simulation offre une formation ancrée dans la réalité du secteur.

-

Face à la complexité croissante de la finance de marché, nous proposons un socle commun de fondamentaux ainsi que quatre spécialisations réparties sur trois campus :

- Trading, Sales et Structuration à Sophia Antipolis,

- Asset Management à Paris,

- Investment Banking à Paris,

- Financial Analysis et le parcours de préparation au CFA® à Raleigh, incluant un visa OPT pour une insertion aux États-Unis / à Wall Street,

- Wealth Management à Dubaï, au carrefour du centre financier du Moyen-Orient, avec une forte orientation sur l’allocation d’actifs, la planification financière et le conseil auprès de clients fortunés.

Image

Les cours s’appuient sur la diversité des parcours académiques et des expériences professionnelles des étudiants. Leur dimension fortement internationale reflète la réalité du travail dans l’environnement économique mondial d’aujourd’hui. L’enseignement est assuré par un subtil mélange de praticiens de renom et de membres de notre corps professoral international, alliant une solide expertise académique à une expérience professionnelle significative.

Découvrez le programme de MSc Financial Markets & Investments en vidéo

MSc Financial Markets & Investment : contenu du programme

Artiste/Entrepreneur/Sportif et étudiant : c’est possible !

SKEMA propose à ces statuts spéciaux des aménagements qui leur permettent de réussir leur double projet : accéder à un diplôme d’études supérieures tout en continuant leur carrière.

Ces parcours s'appuient sur la flexibilité de programme et notamment sur un système de cours intégrant des mesures adaptées à chaque activité afin d'apporter une véritable solution pour aboutir à la réussite du double projet.

Le parcours sportif de haut niveau

Le système de cours offre aux étudiants :

- Possibilité d’un allongement de la durée des études (de 1 à 2 ans) sans majoration des frais de scolarité (SHN) / dédoublement des années scolaires.

- Aménagement personnalisé de l’emploi du temps après étude détaillée des calendriers sportif et académique

- Accompagnement personnalisé incluant un tutorat académique et sportif, le suivi et des aides spécifiques dédiés aux problématiques des sportifs.

- Aménagement des modalités de stages et des examens en cas de compétition.

- Aménagement de l’expérience internationale si nécessaire

- Valorisation de l’engagement sportif par l’obtention de 3 crédits ECTS

Pièces à fournir en complément de votre candidature :

- CV sportif avec Palmarès

- Lettre de motivation sportive

- Copie de la Licence Fédérale de l'année en cours ou attestation de club

- Objectifs sportifs, planning d'entraînement et de compétition pour l'année à venir

- Attestation de liste ministérielle Jeunesse et sports ou du centre de formation (si en votre possession)

Conditions d'admission

Image

| Label reconnu et certifié par l’État, permettant de garantir la qualité des dispositifs d’accueil offerts aux étudiants internationaux. Voir la vidéo |

Financement

Frais de scolarité pour l’année académique 2026-2027, donnés à titre indicatif et susceptibles d’évolution. Le montant définitif sera celui indiqué sur le contrat au moment de l’inscription.

Opportunités de carrière après le MSc Financial Markets & Investments

Obtenir un Master of Science en Financial Markets & Investments à SKEMA ouvre les portes à un large éventail de carrières à fort potentiel dans le secteur financier. Voici ce à quoi vous pouvez vous attendre après l’obtention de votre diplôme :

Témoignages

Nous contacter

Une équipe est à votre disposition pour tout renseignement complémentaire.

International Admissions Development Manager

Pierre AVOT

Nos évènements tout au long de l'année

MSc Financial Markets & Investments - Q&A

-

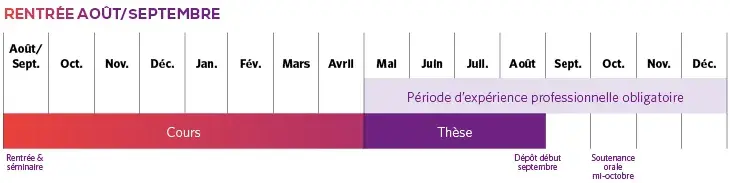

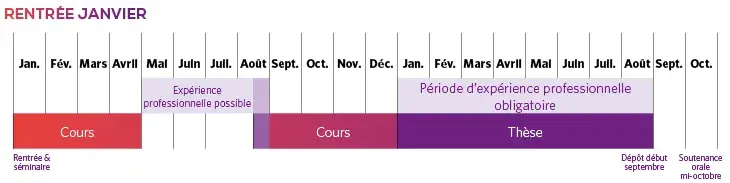

- Le MSc One-Year est un programme à temps plein réalisé en une année universitaire, disponible sur les campus de Paris, Sophia Antipolis et Raleigh

- Le MSc Two-Year s’étend sur deux années universitaires, la première année étant consacrée aux cours fondamentaux, la deuxième à la spécialisation avancée et à la préparation professionnelle. La première année est proposée sur sept campus : Paris, Sophia Antipolis, Lille, Belo Horizonte, Raleigh, Suzhou et Dubaï, tandis que la deuxième année est disponible sur les campus de Paris, Sophia Antipolis et Raleigh.

-

Oui. Chaque campus propose un parcours spécifique. Vous pouvez choisir votre campus en fonction de la spécialisation qui correspond à vos objectifs professionnels. Quel que soit le lieu, tous les parcours préparent les étudiants à une large gamme de métiers de la finance.

-

Le MSc Financial Markets & Investments (FMI) de SKEMA a une dimension résolument internationale, comme en témoigne le fait qu’une grande majorité des diplômés travaillent hors de leur pays d’origine. Le programme ouvre les portes à de nombreux secteurs, notamment la finance, la banque, l’assurance, le conseil et l’ingénierie, et prépare à des carrières variées telles que trader, broker, analyste financier, gestionnaire d’actifs ou de portefeuille, banquier d’investissement, gestionnaire des risques, spécialiste en private equity ou gestionnaire de patrimoine. Les opportunités de carrière sont renforcées par des spécialisations propres à chaque campus, permettant à chaque étudiant de cibler le secteur ou le métier correspondant à ses ambitions. Les diplômés du MSc FMI sont recrutés par des entreprises reconnues mondialement, preuve de la reconnaissance internationale du programme et de sa forte employabilité.

-

Le programme accueille des étudiants issus de divers parcours académiques et professionnels. Les modules de base permettent d’acquérir les connaissances fondamentales avant d’aborder des sujets avancés. Pour être admis et réussir dans ce programme, il est cependant conseillé de ne pas être complètement novice dans un ou plusieurs domaines liés : économie financière, analyse financière, programmation VBA ou Python, fondamentaux des instruments financiers et classes d’actifs, ainsi que mathématiques de base.

-

Les étudiants ont accès à :

• Des terminaux Bloomberg pour les données financières en temps réel et l’analyse

• Des outils de simulation pour une expérience de trading en temps réel

• Des conférences données par des professionnels de la finance de haut niveau

• Des services carrières et des opportunités de réseautage avec des anciens élèves et des recruteurs -

L’enseignement combine rigueur académique et application concrète. Le corps professoral comprend des docteurs et des experts du secteur. Le programme est constamment mis à jour pour refléter les tendances du marché et les attentes des employeurs.

-

Oui. Le MSc FMI est classé 2ᵉ mondial dans le classement Finance 2025 du Financial Times. Il bénéficie d’une forte reconnaissance auprès des employeurs internationaux et s’appuie sur des partenariats avec des organismes majeurs du secteur, comme le CFA® Institute.

En rejoignant un MSc, les étudiants obtiennent un diplôme de Master of Science ainsi que le "Diplôme d’Études Spécialisées en Management International" (DESMI), diplôme reconnu par le Ministère français de l’Éducation Nationale, de l’Enseignement Supérieur et de la Recherche (niveau master). Plus d’infos - texte en français.

-

Le MSc Financial Markets & Investments (FMI) s’adresse aux étudiants souhaitant travailler sur les marchés financiers, avec un focus sur le trading, le structuring, la gestion de portefeuille, la banque d’investissement et la gestion d’actifs. Il propose des spécialisations couvrant à la fois le buy-side et le sell-side, avec une filière dédiée à la préparation du CFA® à Raleigh. Le programme est très orienté marché, avec une formation pratique sur terminaux Bloomberg, jeux de simulation et outils quantitatifs utilisés en front-office.

En revanche, le MSc Corporate Financial Management (CFM) prépare aux métiers de la finance d’entreprise et du conseil au sein des entreprises, cabinets de conseil ou fonds de private equity. Il met l’accent sur la stratégie financière, la levée de fonds, les fusions-acquisitions, la gestion des risques et les innovations fintech, avec cinq parcours de spécialisation, dont Financial Advisory, Private Equity, Fintech et Risk Management. Le programme CFM privilégie les projets en entreprise, la modélisation financière et l’apprentissage hybride pour appliquer la finance aux défis réels des entreprises.

-

• Objectifs et positionnement

Le MSc FMI de SKEMA se distingue par son fort accent sur les marchés financiers et les carrières en front-office. Il prépare aux métiers du trading, de la gestion d’actifs, de la finance quantitative et de la recherche en investissement.

À l’inverse, de nombreux masters finance traditionnels proposent une vision plus généraliste, combinant finance d’entreprise, comptabilité et finance de marché sans spécialisation poussée. Le MSc FMI est idéal pour ceux qui veulent se spécialiser dans les marchés de capitaux plutôt que dans des fonctions financières plus larges.

• Contenu du programme et spécialisations

Le programme FMI est très technique et orienté professionnalisation. Il comprend des modules approfondis sur les dérivés, la gestion de portefeuille, l’ingénierie financière, la modélisation des risques et la programmation (Python, VBA). Il prépare également à des certifications internationales reconnues comme le CFA, FRM ou CAIA.

Les autres masters finance proposent souvent moins de contenus techniques, avec une approche plus généraliste et des spécialisations souvent optionnelles ou moins axées marché. FMI offre dès le départ un parcours cohérent et spécialisé, ancré dans des cas concrets de marché et des applications pratiques.

• Opportunités de carrière

Les diplômés du MSc FMI accèdent souvent à des postes dans des banques d’investissement de premier plan, hedge funds, sociétés de gestion d’actifs et institutions financières, en front-office ou dans des rôles quantitatifs (analyste financier, trader, quant, assistant portefeuille).

En comparaison, les diplômés de masters finance généralistes occupent des postes plus variés, notamment en finance d’entreprise, audit interne ou contrôle financier, moins directement liés aux marchés de capitaux.

La forte implantation de SKEMA dans des centres financiers clés (Londres, Paris, Genève), ainsi que son alignement avec les attentes et certifications du secteur, renforcent nettement l’employabilité des diplômés sur les marchés financiers mondiaux.

-

Oui, SKEMA propose plusieurs bourses et aides financières pour les étudiants internationaux et nationaux. Cela inclut des bourses au mérite, des aides basées sur les besoins, ainsi que des aides spécifiques par pays ou campus. Pour plus d’informations sur les critères d’éligibilité et les procédures de candidature, veuillez consulter la page dédiée au soutien financier de SKEMA.